“Transform policy sales with an Insurance Policy Comparison Tool AI. It simplifies complex jargon, guides customers to their perfect coverage, and converts confused visitors into confident, qualified leads.”

You’ve seen the look.

It’s the look of confusion, frustration, and mounting anxiety. It’s the look a potential client gets when you hand them a comparison quote or send them to a webpage with a grid of policy options. Their eyes glaze over as they try to decipher a wall of text filled with words like “indemnity,” “subrogation,” “premiums,” “deductibles,” and “riders.”

They came to you, or to your website, seeking a straightforward answer to a simple question: “What’s the best insurance for me?”

Instead, you’ve given them a research project.

As an insurance agent or broker, your greatest asset is your expertise. Your job is to be the guide, the translator, the trusted advisor who navigates this complex world for your client. But what happens before they ever talk to you? How many potential clients—good, qualified leads—simply give up and leave your website because the process is too complicated?

The traditional way of selling insurance online is broken. We force customers to become mini-actuaries, comparing dense tables of data and trying to guess which “apples-to-oranges” policy is the right fit. They are paralyzed by choice, terrified of making the wrong decision, and ultimately, they often choose to do nothing.

This is where the game changes. This is where you stop being a data provider and start being a problem-solver, 24/7.

The solution is not another spreadsheet or a flashier comparison table. The solution is a conversation.

Imagine a tool on your website that not only displays data but also provides in-depth analysis and discussion. An assistant that, instead of showing 15 policy options, asks a simple question: “Hi there! I’m here to help. To start, are you looking to cover yourself, your family, or your business?”

This is the power of an AI-powered insurance policy comparison tool. It’s a conversational assistant that transforms the complex, confusing, and cold process of buying insurance into a simple, personal, and guided experience.

In this guide, we will explore why this shift is not just a nice-to-have but an absolute necessity for the future of your agency. We will examine the deep-seated problems with the old way, the incredible benefits of the new approach, and finally, how you can build your own AI assistant (for free, without writing a single line of code).

The Core Problem: Why Clients Drown in Data

Before we talk about the solution, we must be brutally honest about the problem. The insurance industry, by its very nature, is built on complex risk assessment and legal contracts. This complexity is often referred to as the “curse of knowledge.” We understand what a “peril” is, but our customers don’t. We know the difference between “actual cash value” and “replacement cost,” but to our clients, it’s just confusing jargon.

This confusion manifests in several ways that actively cost your agency money.

1. The Nightmare of Jargon

Let’s face it: we have a language problem. We use words that no one outside of an underwriter’s office uses.

- Premium: The price (okay, this one’s easy… mostly).

- Deductible: The money you pay before we pay.

- Co-pay: The other money you pay when we pay.

- Indemnity: A promise to make you “whole” again.

- Subrogation: When we pursue the other party’s insurance company for reimbursement of our expenses.

- Exclusions: The long, scary list of all the things we don’t cover.

A customer comparing two life insurance policies notices that “Policy A has a graded death benefit for the first two years” and “Policy B has an accelerated death benefit rider.” They have no idea what this means. So, what do they do? They default to the only metric they do understand: price.

This is a disaster. It starts a race to the bottom. It turns your expert advisory service into a commodity. The client typically buys the cheapest plan, which is often not the best option for them. Then, when a claim is denied because they’re not covered for something they didn’t understand, who do they blame? They blame you.

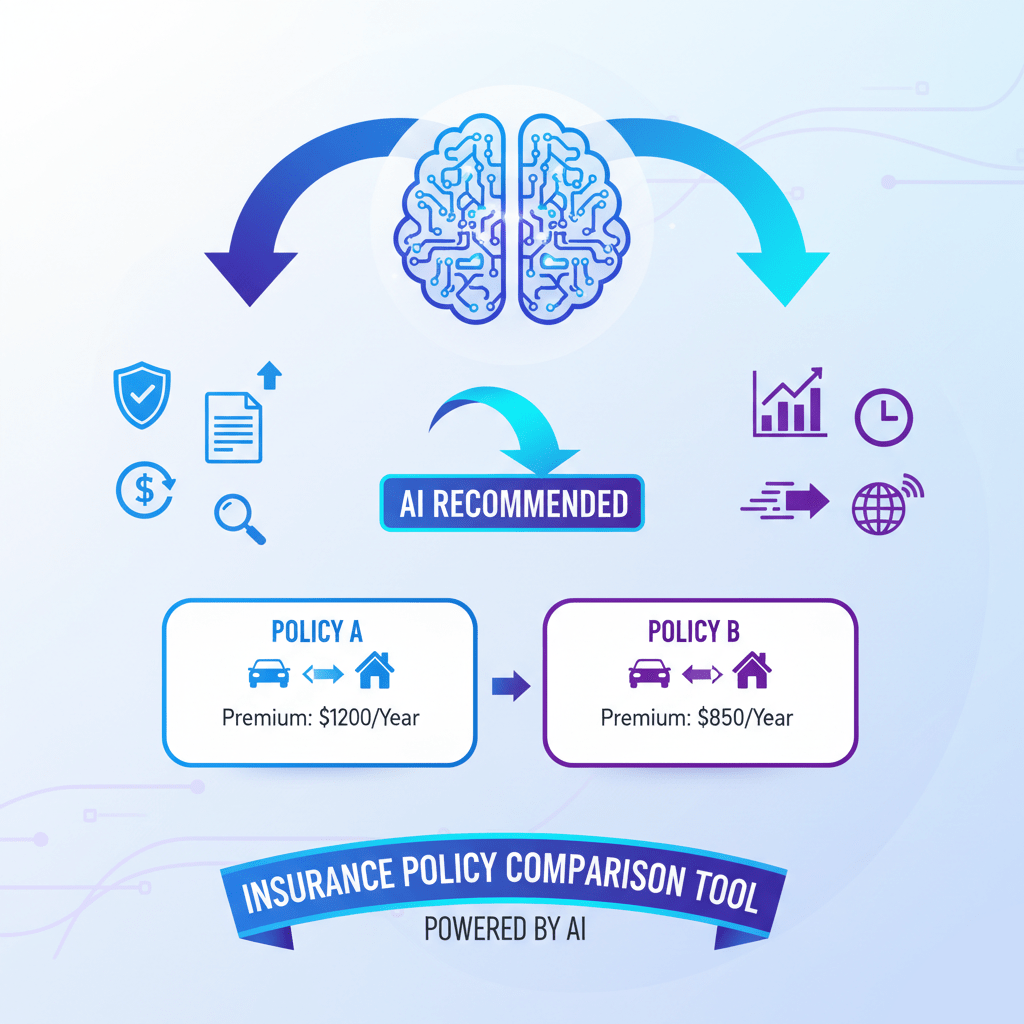

2. The “Apples-to-Oranges” Comparison Grid

The second major failure is the visual tool we use: the comparison grid.

You’ve seen them. You could even use one. It’s a table with policy names in the first column and features in the subsequent columns.

- Policy A: $100/month, $1,000 deductible, $500k coverage

- Policy B: $110/month, $500 deductible, $500k coverage

- Policy C: $95/month, $1,000 deductible, $250k coverage, no flood damage

The customer is left to do the math. “Okay, Policy B is $10 more per month… that’s $120 a year. But the deductible is $500 lower. Is that a good trade? Wait, Policy C is cheap… but what if I need $500k coverage? What’s ‘flood damage’? Does that count if a pipe bursts?”

This is not a buying experience; it’s a logic puzzle. And it’s a bad one.

This static, data-dump approach fails because it lacks context. It doesn’t know that this customer has two young children and a mortgage (making Policy C a terrible idea). It doesn’t know they have a 16-year-old son about to start driving (making a low deductible and accident forgiveness on Policy B a great idea).

Traditional insurance quoting software just gives a number. It doesn’t guide insurance selection. It simply provides the rope for a confused customer to hang themselves with.

3. The Cost of Inaction (and What It’s Doing to Your Business)

The result of this confusion is “decision paralysis.” A confused mind always says “no,” or “I’ll think about it.”

For your agency, this translates directly to:

- High Bounce Rates: Visitors arrive at your quoting page, become overwhelmed, and leave without completing the process. Google sees this and ranks your site lower.

- Abandoned Carts: They might even start the process, fill in their name and address, see the grid… and vanish.

- Unqualified Leads: The few leads you do receive are often price shoppers who have no loyalty and will switch to a competitor to save $5.

- Wasted Agent Time: Your agents spend the first 20 minutes of every call just re-explaining the basics. They are stuck in “Education Mode 101” instead of “Advisory Mode 501,” where they can actually cross-sell, upsell, and build authentic relationships.

The old model forces the customer to do all the work. The new model, powered by conversational AI, does the work for them.

The Solution: From “Compare This” to “Tell Me About You”

Imagine that same customer landing on your website. But this time, there’s no grid. There’s just a friendly chat window in the corner.

It pops up with a simple message:

“Hi there! I’m your policy assistant. Finding the right insurance can be tough, but I’m here to make it simple. Can we talk for a minute about what you need?”

This is the fundamental shift. You are moving from a data-first model to a needs-first model.

A conversational AI tool isn’t just a chatbot. A simple chatbot can only answer basic, pre-programmed questions, such as “What are your hours?” or “Where is your office?” An accurate AI-powered comparison tool is an intelligent coverage recommendation engine.

It works like this:

Step 1: The Needs-Based Interview

The AI doesn’t start with products. It begins with the person. It engages in a simple, guided conversation, like a real agent would. This is a real-time life insurance needs analysis or an auto insurance needs analysis.

Example: Auto Insurance

- AI: “Great, let’s look at auto insurance. First, what’s the primary vehicle you’re looking to insure? (Make, Model, Year)”

- User: “A 2021 Toyota RAV4.”

- AI: “Got it. And who will be the main drivers in your household?”

- User: “And my husband. Oh, and my daughter just got her learner’s permit.”

- AI: “That’s a key detail! Adding a teen driver can be tricky. We’ll want to look for policies with ‘new driver forgiveness’ and strong multi-car discounts. Now, what’s more important to you: keeping your monthly premium as low as possible, or having a lower deductible so you pay less if you have an accident?”

- User: “I’d rather pay a bit more each month to know I won’t get hit with a huge bill.”

Do you see what’s happening? In just 30 seconds, the AI has gathered more meaningful data than any static form. It knows the user’s vehicle, their family structure, and their risk tolerance. It has already narrowed the field from 15 policies down to the 2 or 3 that actually make sense.

Example: Life Insurance

- AI: “Welcome. Finding the right life insurance is a big step. To help, can you tell me who you’re looking to protect? Is it a spouse, children, or perhaps a business partner?”

- User: “My wife and our two young kids.”

- AI: “That’s wonderful. The main goal is then to ensure they’re taken care of in the event of anything happening. Do you have a mortgage or other major debts we should think about?”

- User: “Yes, we just bought a house.”

- AI: “Okay. We need a plan that can help cover the mortgage and replace your income for a while. Are you looking for a policy that just covers you for a set period (like 20 or 30 years, known as ‘Term’ life), or a ‘Permanent’ policy that builds cash value over your whole life?”

The user doesn’t need to know what “Term” or “Permanent” means before the conversation. The AI introduces the concepts simply, in the context of their life.

Step 2: The Plain-Language Explanation

This is where the magic happens. The AI’s job is to simplify insurance jargon. After the needs analysis, it not only presents a quote but also provides a comprehensive solution. It presents a recommendation.

- AI: “Okay, based on what you told me, I have two options that are a great fit.

- Option 1: The ‘Peace of Mind’ Plan. This one has the lower $500 deductible you wanted. It also includes our ‘Teen Driver’ package, which means your rate won’t automatically skyrocket after her first minor fender-bender. It’s $150/month.

- Option 2: The ‘Budget-Friendly’ Plan. This one is $120/month, but the deductible is $1,000. It’s still great coverage, but you’d be responsible for the first $1,000 in a claim.

- Both plans include roadside assistance and $300,000 in liability. Does one of these sound like a better fit for your family’s needs?”

This is the “ah-ha!” moment for the customer.

It’s not a grid. It’s a story. It’s a choice between two clear, understandable paths, each with a name and a “why” that directly connects to its stated needs. The AI has successfully explained policy differences without forcing the user to read a 40-page PDF. It has created personalized insurance plans on the fly.

This simple, conversational approach removes all the friction. It builds confidence. The customer feels understood. They feel smart. A customer who feels competent and confident is ready to make a purchase.

The Business Case: How This Transforms Your Agency

This all sounds great for the customer, but what about you? This isn’t just a gimmick; it’s a powerful business tool that directly impacts your bottom line in four critical ways.

1. A 24/7 Lead Generation Machine

Think about your website right now. It’s a passive brochure. It just sits there, waiting for someone to be motivated enough to fill out a “Contact Us” form.

An AI comparison tool turns your website into an active employee. It’s an agent who never sleeps, never takes a vacation, and can handle a thousand conversations at once.

Every person who interacts with the AI is a hot, qualified lead.

When that lead is finally sent to your human agents, imagine what they receive. Instead of just a name, email, and “wants auto quote,” they get a full transcript:

New Lead: Sarah Jenkins

- Product: Auto & Home Bundle

- Vehicles: 2021 Toyota RAV4, 2019 Honda Civic

- Drivers: Sarah (42), Mark (43), Emily (16)

- Home: 4-bed, 3-bath, $450k mortgage

- Key Concerns: Adding a teen driver, low-deductible auto insurance, and needing sewer backup coverage for the new finished basement.

- AI Recommended: ‘Premier Bundle’ (Option A) and ‘Standard Bundle’ (Option B).

- Status: Sarah is “leaning toward Premier” and has a question about bundling an umbrella policy.

This is a game-changer. Your agent isn’t starting from zero. They are picking up the conversation on the 10-yard line. They can skip the basic fact-finding and proceed directly to high-value advisory work. They can open the call with:

“Hi Sarah, I see you were talking with our AI assistant about bundling your home and auto. It looks like you have a great plan picked out. You had a smart question about adding an umbrella policy, and I can definitely help with that…”

You’ve just compressed a 30-minute introductory call into 30 seconds. Your agent is now a consultant, not an order-taker. This is how you supercharge lead generation for agents.

2. Building Trust Through Transparency

Trust is the single most valuable currency in the insurance industry. But the traditional sales process often feels adversarial. Customers are on guard, expecting a hard sell.

The AI assistant completely changes this dynamic.

- It’s Patient: It will happily re-explain what a “deductible” is ten times, at 3 AM, without ever getting frustrated.

- It’s Unbiased (or, your bias): The AI is programmed with your best practices. It will always recommend the policy that you would recommend, based on the rules you set. It’s a perfect digital clone of your best agent.

- It’s Not Pushy: The AI’s job isn’t to “close.” Its job is to “inform.” This no-pressure environment allows customers to explore and learn at their own pace.

When the customer finally talks to you, they’re not a skeptic; they’re a collaborator. They’ve already been “warmed up” by a helpful, transparent experience. They trust your brand before they’ve even spoken to a human.

3. Slashing Operational Costs and Boosting Efficiency

How much of your team’s day is spent answering the same 20 questions?

- “How do I file a claim?”

- “Can I pay my bill online?”

- “What’s my deductible?”

- “Do I need renters’ insurance?”

These are “low-value” (but high-frequency) interactions. They are critical to customer service, but they are a drain on your licensed agents’ time.

Your AI assistant can handle 80-90% of these routine inquiries instantly. This frees up your human talent to focus on what they do best:

- Closing complex deals: (e.g., high-net-worth individuals, complex commercial policies).

- Proactive relationship building: (e.g., calling clients for annual policy reviews).

- High-empathy situations: (e.g., walking a client through a complex claim).

You don’t need to hire more staff to handle growth. You just need to make your current staff more efficient. The AI acts as a force multiplier for your entire team.

4. Improving Client Outcomes and Retention

This might be the most crucial benefit of all. A customer who understands their policy is better and happier.

When a client actively chooses a $1,000 deductible with the AI’s help, they own that decision. They understand the trade-off. They are infinitely less likely to be angry when they have a claim and have to pay that $1,000. They won’t say, “You tricked me!” or “I didn’t know!”

This educational process, built into the sales funnel, leads to:

- Fewer misunderstandings and “I-thought-I-was-covered” complaints.

- Higher client satisfaction, because the policy they have is actually the policy they need.

- Increased retention and loyalty.

- More referrals, because people love to share a simple, smart experience with their friends.

“This Sounds Great, But How Do I Build It?”

At this point, you’re in one of two camps.

- “I love this. I’ll get my IT team and a million-dollar budget, and we’ll build it.”

- “I love this. But I’m a 10-person agency. I don’t have an IT team or a million-dollar budget. This is a fantasy.”

Five years ago, Camp 2 was right. Building an actual AI engine that could understand natural language, parse complex policy PDFs, and hold a coherent conversation was the exclusive domain of the giant national carriers. It required armies of data scientists, developers, and massive computing power.

This is no longer true.

The revolution of the last few years has been the rise of no-code AI platforms.

These platforms are the “great equalizers.” They put the power of a “Big 4” carrier’s tech department into the hands of a local, independent agent.

You no longer need to know how to code. You just need to know your business. You bring the “knowledge”—your policies, your benefit summaries, your underwriting rules, your FAQs—and the platform provides the “intelligence.”

This means an independent broker in Omaha, Nebraska, can have an AI assistant on their website that is just as smart, helpful, and effective as the one on a multi-billion-dollar carrier’s homepage.

This is the democratization of technology. And it brings us to the final, most practical part of this guide.

Your Solution: Meet Scalewise.ai

If the “what” is a conversational AI assistant, and the “why” is to generate leads and build trust, the “how” is Scalewise.ai.

We built Scalewise.ai for one specific reason: to solve the exact problem we’ve just spent this entire article discussing. We believe that every agent and every agency deserves access to this powerful technology… and they shouldn’t have to be a tech genius or a millionaire to obtain it.

Scalewise.ai is a free, no-code AI Agent Builder.

Let’s break that down.

- Free: Yes, really. You can sign up and build your first AI agent today without putting in a credit card.

- No-Code: If you can drag-and-drop a file, you can use Scalewise.ai. You don’t write any code. Ever.

- AI Agent Builder: You are not just building a chatbot. You are building an intelligent agent that learns from your specific materials.

How It Works: The 3-Step Process

This is how simple we’ve made it.

Step 1: Create Your Free Account.

This takes about 30 seconds.

Step 2: Upload Your Knowledge.

This is the magic. You go to your ‘Knowledge’ section and simply upload the documents you already have.

- Your carrier’s policy PDFs.

- Your internal benefit summaries.

- Your agency’s “Frequently Asked Questions” doc.

- Marketing brochures.

- Your website’s existing pages.

Scalewise.ai reads and understands it all in seconds. It becomes an expert on your products, your rules, and your agency’s voice.

Step 3: Embed on Your Website.

We provide you with a single code snippet. You (or your website person) copy and paste it into your site. Instantly, the little chat bubble appears in the corner, and your new AI assistant is live, ready to talk to your customers.

That’s it.

There is no six-month development cycle. There are no data scientists. You can go from “idea” to “live on my site” in less than an hour.

Your new AI agent can now:

- Answer specific questions about the policies you uploaded.

- Compare policies based on features (“Which of these plans covers a rental car?”)

- Explain policy differences in simple terms.

- Guide insurance selection with needs-based questions.

- Capture lead information and send you a full transcript of the conversation.

You are empowering your customers. You are giving them a tool to educate themselves and make a confident choice. You are building a rock-solid foundation of trust before you ever even say “hello.”

And in doing so, you are freeing up your team to do the human-centric work that no AI will ever be able to replace: building relationships, providing empathy, and closing the deals that matter.

Conclusion: Don’t Just Display, Engage

The future of insurance is not about data dumps. It’s not about confusing grids or a race to the bottom in terms of price. The future is advisory, personal, and conversational.

Your customers are not looking for a spreadsheet; they are looking for a guide.

For years, the only way to be that guide was to wait for the phone to ring or for a lead form to come in. Today, you can be that guide for every single person who visits your website, 24/7, with the help of an AI-powered insurance policy comparison tool.

This technology is no longer a far-off fantasy. It’s here, it’s accessible, and it’s ready to go to work for you. By transforming your “brochure” website into an interactive, intelligent assistant, you’re not just buying software. You’re building a better, more innovative, and more profitable agency.

Stop forcing your customers to do the work. Stop letting them drown in data. Start the conversation.

Ready to build your own AI assistant in the next 10 minutes? Get started with Scalewise.ai for free.

Frequently Asked Questions (FAQs)

Q: Will this AI assistant replace my human agents?

A: Absolutely not. It amplifies them. The AI is designed to handle the repetitive, top-of-funnel questions and to pre-qualify leads. This frees your human agents to do what they do best: build relationships and close complex deals. It’s not about replacing agents; it’s about making them “super-agents.”

Q: Is my policy data secure with Scalewise.ai?

A: Security is our top priority. We use industry-standard encryption and security protocols to ensure that all the “knowledge” you upload is protected. Your data is your data; we just provide the intelligence engine to use it.

Q: What if the AI gives a wrong answer or bad advice?

A: This is a great question. The AI’s answers are based only on the information you provide it. It’s not “creative” and won’t make things up. If your policy PDF says “sewer backup is excluded,” the AI will say “sewer backup is excluded.” You can also set up rules and “guardrails” to ensure it consistently provides compliant and accurate information. Additionally, you have complete logs of all conversations to review for quality assurance and training purposes.

Q: I am not technical. How hard is this to set up?

A: We mean it when we say “no-code.” If you can attach a file to an email, you have the technical skills to build your AI agent. You upload your documents (such as Word documents, PDFs, or even just point it to your website), and the system takes care of the rest.

Q: Can it handle complex, multi-policy questions (e.g., home and auto bundles)?

A: Yes. When you upload your policy documents for home, auto, and umbrella, the AI can cross-reference them. A user can ask, “What are the benefits of bundling my home and auto?” and the AI will be able to explain the specific discounts and coverage benefits based on your products.

Q: How long does it really take to get started?

A: You can sign up, create your agent, upload 5-10 policy documents, and have a functional AI assistant embedded on your website in under an hour. Fine-tuning it and adding more knowledge might take a bit more time, but the “time to value” is speedy.